In its latest report titled ‘India Hotels Outlook: Impact of COVID-19’, HVS ANAROCK expects secondary and tertiary markets to hold up better than gateway and metro markets, which are expected to witness short-term volatility.

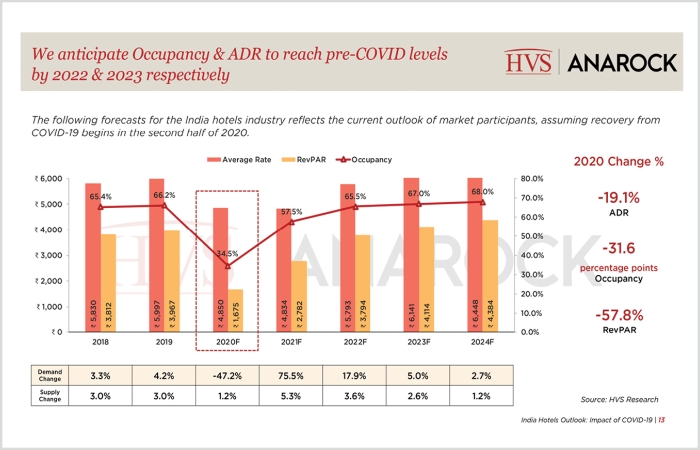

Going by predictions made in HVS ANAROCK’S latest report that not only analyses the performance of the Indian hotel sector under the current COVID-19 pandemic but also compares its recovery to events of the past (9/11 and the Global Financial Crisis of 2008), occupancy and ADR are expected to reach pre-COVID levels by 2022 and 2023, respectively, with supply growth expected to remain dormant. This is assuming recovery from COVID-19 begins in the second half of 2020.

In fact, the report reveals that both occupancy and ADR will recover much quicker in this cycle due to limited supply growth, subject to a vaccine being in place not later than 2021.

Outlook for demand

According to the analysis, while business midscale and economy hotels will recover faster than their luxury and upscale counterparts, the case will be quite the opposite in the leisure segment. Here, luxury and upscale hotels will recover quicker than their economy and midscale counterparts.

Outlook for supply growth

As of May 2020, supply was forecast to increase at a CAGR of 2.8 per cent during the 2020-2024 period. Given the recent events, supply growth is now expected to be lower, and at a slower pace, than previously anticipated. The report states that some properties are likely to be repurposed to other asset classes such as hospitals, student housing, as well as co-living spaces.

- Under-construction projects may face delays due to labour shortages and issues pertaining to vendors and supply chain.

- Muted market conditions will likely lead to delayed openings; some projects may be on hold pending recovery.

- Financing challenges on account of negative sentiment for sector is likely to delay projects.

Key takeaways

- This cycle could be unique in terms of the rapid and dramatic decline of demand, like never seen before, but there could be some similarities to other cycles.

- Secondary and tertiary markets are expected to hold up better. Gateway and the top 10 metro markets will witness short-term volatility.

- Supply growth is expected to slow significantly, as new or under construction projects are delayed or abandoned and several highly leveraged assets are shutdown.

- The pace of immediate demand growth is co-related to the level of stimulus infused by the government to revive growth, besides the availability of a cure and vaccine.

- The transaction market will witness high activity due to likely softening in values and increased availability of stressed assets.

Outlook for demand

Corporate: Corporates are

expected to put restrictions on non-essential employee travel. Even for the essential employee travel, allowance limits are likely to be reduced. Senior Management travel is also expected to reduce in the short term.

M!CE: The number of international corporate M!CE travellers will be significantly reduced. A large number of weddings planned at international destinations have also relocated to domestic destinations. The size of the weddings will be reduced.

Leisure: Domestic tourists will be major demand drivers. ‘Revenge’ travel witnessed in China could foster among Indians, too. The 25 million outbound Indian travellers will also be an attractive segment for the leisure market.

TravTalk India Online Magazine

TravTalk India Online Magazine