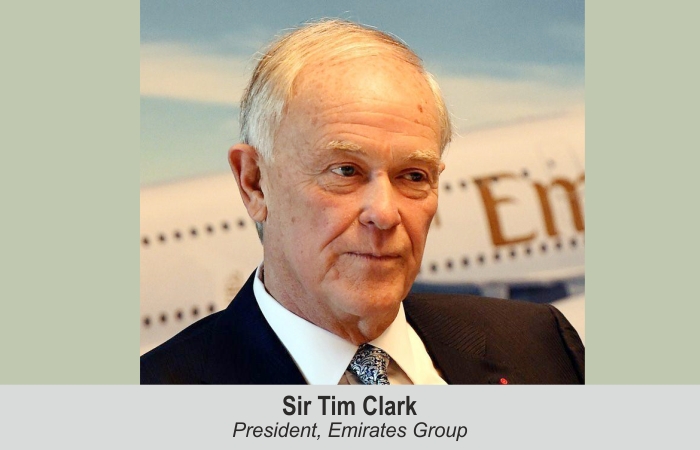

Sir Tim Clark, President, Emirates Group, has said that low-cost carriers would benefit when the aviation sector resumes in a post-COVID world, thanks to a strong domestic demand in the US, China and Europe. He adds that business travel will return in absolute terms, but airlines have to be ready to adapt to a changed nature of demand.

Nisha Verma

Sir Tim Clark is optimistic that the aviation sector will soon recover to 2019 levels. “The ideal situation is that the vaccine programme beats the virus by Autumn of this year, and we get some relief when demand comes back at a staggering rate. Low-cost (airlines) will benefit from intra-European travel, the US domestic market, China’s domestic market and international travel will (also) return in large numbers. But, the problem (with this scenario) will be twofold: one, the ability of airlines to meet the demand when it comes and two, the conditionality of country access requirements,” he said, speaking at Virtual Arabian Travel Market 2021.

Sir Clark further said that despite a pent-up demand, there may be concerns about variant strains of the coronavirus. Giving India’s example, he said that the situation is creating a ripple effect across the global economy. “It’s a question of how we navigate the next six months and if we do it right with equitable vaccine distribution, testing regimes simplified and made cheaper, all of this lends to the theory that by the end of the year, we’ll be back in business in some scale,” he added.

Future of business travel

Talking about business travel, he said, “Business travel will return in absolute terms, but segments will change. Airlines will have to adapt to the changing nature of demand. An a la carte menu for Business Class, which allows you to pick and choose products at various price points that go with it, is a smart idea.”

In terms of a more long-term outlook, he added that the world will eventually overcome the pandemic, however, according to him, the most important thing is to “crack the problem”.

A word on Emirates

Claiming that Emirates is performing better than was initially expected, Sir Clark said, “We are a lot further on and much better than we would be at this time. I am not saying that’s good. It is just better than what we thought we would be when we looked at it in the Spring of last year. We activated passenger aircraft as soon as we could and cargo was always on.”

That said, he dismissed the possibility of a merger with budget carrier flydubai, and claimed that the two airlines will continue to operate independently. “The brands would remain separate but, going forward, the airlines would operate far closer than they have perhaps done in the past. There will be a rationalisation of networks. Notwithstanding, the competitive issue is something that we have to be careful about,” he said.

Jets, jets & jets

Emirates is one of Boeing’s biggest customers. Sir Clark has warned the American manufacturer that it would refuse delivery of 777X jets if they can’t fulfil contractual performance commitments.“There are issues on that aeroplane, and I’m not entirely clear as to when we’re going to get them. What I’ve said to Boeing is, we will not accept an aeroplane unless it is performing 100 per cent to contract, for the same reason they expect us to pay 100 per cent to contract at delivery,” he shared.

Emirates has a fleet of around 140 Boeing 777-300s and 115 Airbus A380s. It has ordered 126 777X and 30 787s worth over $50 billion at list prices with Boeing. Emirates was supposed to receive its first 777X last July, and now Sir Clark says that they have concerns that it will start receiving the jets by 2024 though Boeing promised them delivery in the backend of 2023. He also said that he has told Boeing to only start commercially producing a new aircraft once it had been fully tested and certified.

Sir Clark has also said that it is not easy for Emirates to operate its A380s in the current scenario.

TravTalk India Online Magazine

TravTalk India Online Magazine