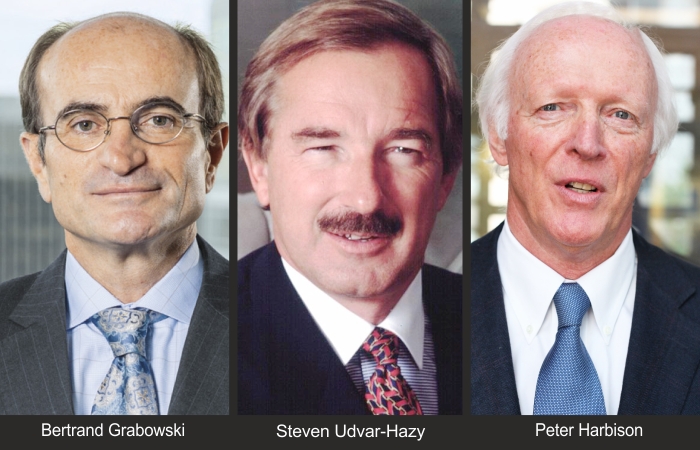

The eighth edition of the CAPA Masterclass Series took a look at the air finance market in the rest of 2020. While some Asian markets are expected to better, some others may be in for tough times. Here’s what the three aviation experts had to say.

Bertrand Grabowski, Independent, Aviation Advisor

I’m still worried about some large segments of the Asian market. We all know that Asia has tremendous potential for growth and if the growth engine in Asia doesn’t work very well, all industries are impacted. We are optimistic about China, but if you look at the rest of Asia, I am still worried about what’s happening in Indonesia, Philippines, and I shall not forget to mention India with more than one billion people under lockdown. I am still more than worried on some large segments of population in countries in SE Asia.

Steven Udvar-Hazy, Executive Chairman, Air Lease Corporation

It is going to be a tough winter. What I also see is that the commercial banking sector is getting very close to its internal limits. Whatever capital the banks have available for the airline industry have pretty much been used up by the best carriers – ones that have either the strongest credit profile or government backing. There’s not a lot of liquidity that they will advance to airlines without government guarantees or strong security such as aircraft. It is going to be challenging for a lot of airlines to raise liquidity.

Peter Harbison, Chairman Emeritus, CAPA – Centre for Aviation

There have been many pay cuts and resetting of the stage on labour costs, but that sort of cathartic approach to the industry is something that was long overdue. In fact, this is not just in this particular area. If we have even a quarter or a third of the industry’s fleet grounded going into 2021, you have to think that there’s a fairly quick erosion of value which flows right through to the capital markets and this

really starts to rock the boat even more.

Airline cash burn could accelerate

IATA reported intra-EU passengers have used a large number of vouchers, issued since mid-March 2020 in lieu of refunds, to pay for travel between June 15, 2020 and July 15, 2020. Airlines are now incurring the deferred cost of transporting these passengers against limited or zero new revenues. IATA stated, “Whilst the issuance of vouchers helped decelerate cash burn a few weeks ago, their use will now accelerate cash burn in the coming months.” The data is based on IATA’s Billing and Settlement Process.

Inputs by Hazel Jain

TravTalk India Online Magazine

TravTalk India Online Magazine