New Distribution Capability (NDC) has been a contentious topic in the travel and tourism industry despite airlines and Global Distribution Systems (GDS) providers positioning it as the future of retailing. Industry leaders recently gathered for a discussion to explore NDC’s role in transforming the sector.

Nisha Verma

New Distribution Technology (NDC) has been dreaded by the travel industry ever since it was introduced, despite airlines and providers of Global Distribution Systems (GDS) saying otherwise. Despite being in existence for a decade, NDS remains misunderstood, with many travel agents hesitant to adopt it.

The big debate

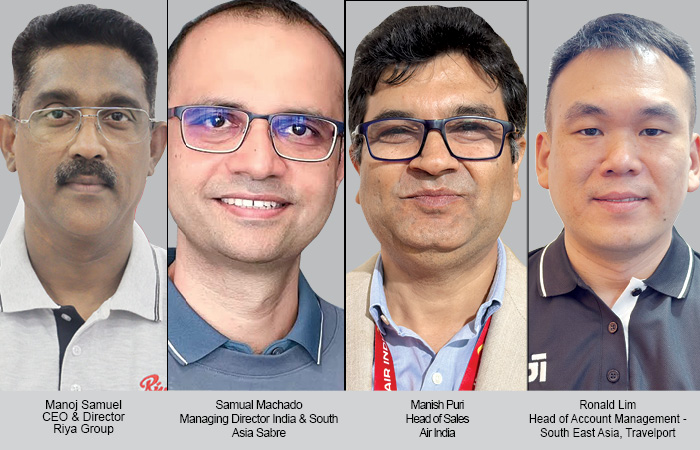

A major concern in the industry has been whether NDC will reduce reliance on GDS. Manoj Samuel, CEO & Director, Riya Group, said, “NDC is the new constant for the travel fraternity. Around 30 per cent of our international business has moved to NDC. However, it will not completely replace GDS. Some airlines will remain on both. Many functions we performed on EDIFACT will shift to NDC, and we must embrace this change.”

Samual Machado, MD India & South Asia, Sabre, said, “NDC is not a product but a way to deliver content. GDS is part of the consumption process. NDC makes content available directly by eliminating intermediaries, allowing airlines to present content in a user-friendly and real-time manner. It also structures data, enabling pricing, schedules, and consumer preferences to be processed separately. The idea that NDC will eliminate GDS is incorrect; rather, it will help airlines remain relevant in the long term.”

Air India & NDC

Manish Puri, Head of Sales, Air India, emphasised that change takes time. “NDC is a new way of selling. We don’t want to do away with GDS. GDS is a platform, while NDC is a new technology for distributing content. If we don’t adapt, we will perish. The world is moving toward retailing, and airlines must change to remain relevant. If we don’t, Amazon will.”

He added, “Air India is one of the fastest airlines in the world to adopt NDC. As our content becomes available, the share of international business via NDC will increase significantly. With our fleet expected to grow to 400-500 aircraft in the next three years, the ratio of bookings through NDC will shift. Technology and ease of adaptation will evolve, and Air India offers multiple ways to access NDC. Travel agents must start working with it.”

Managing NDC with GDS

Ronald Lim, Head of Account Management – South East Asia, Travelport, noted, “NDC strengthens both GDS and airlines. Achieving interlining has always depended on carrier agreements and technology. Travelport is focused on normalising NDC content into agency workflows. Though NDC is over a decade old, its adoption is still at an early stage. As more airlines join, interlining agreements will follow.”

Level-playing field

Asked whether all airlines offer NDC content to Indian travel agents, Machado explained, “All GDSs have a fair number of airlines available. Airlines decide which markets to open NDC to based on dynamics and costs. Important airlines like Air India are already on board. The travel fraternity must push airlines to open NDC access for Indian consumers, making it a collective effort.”

Adapting to consumer needs

Puri emphasised the need for airlines to evolve with changing consumer expectations. “We have to give unbundled or bundled products to our customers to make a choice. Things are moving fast—if we have Wi-Fi on board and I want to sell it, but 90 per cent of my content is on a GDS today, I cannot sell it. The differentiation comes when my website sells it, while agents on EDIFACT cannot. This is often seen as airlines taking customers away from travel partners, but in reality, it’s about offering what the customer demands.”

Need for aggregators

Lim highlighted the appeal of aggregators in NDC distribution. “With new technology, we are always open to exploring possibilities. Aggregators promise speed—the speed at which they roll out and distribute airline content. GDS, however, is not just about selling content; we focus on the entire workflow, meeting the expectations of travellers and travel agencies.”

He noted that while aggregators quickly push content, GDS ensures a structured approach. “Once airlines scale up, GDS will catch up with aggregators in speed and capabilities. The importance of GDS will resurface, reminding all stakeholders of its role in the travel ecosystem.”

Sharing his views on the issue, Samuel said, “Aggregators are the third piece in this whole discussion. However, I think they might not be able to scale the way the GDS gets scaled. Plus, they don’t have the distribution capacity that GDS has.” Machado clarified, “There is a misconception—GDS itself is an aggregator, bringing together full-service carriers, low-cost carriers, NDC content, hotels, and more. GDS now provides a seamless content pipeline at a reasonable price, so businesses can focus on creating AI-driven layers on top. AI simulates human intelligence, but it cannot yet perform logical reasoning or problem-solving without structured, granular data. NDC enables this, offering the next generation of businesses a faster way to innovate using AI.”

NDC training must

Samuel acknowledged the internal challenges of transitioning from EDIFACT to NDC. “We have around 1,200 staff internally, and for them to move away from EDIFACT is a big challenge. We have been conducting continuous training for the past year. Additionally, we have started smaller sessions for our partners, helping them adapt to portals and multiple API content.”

Machado urged agencies to engage more actively. “We are spending millions on education, yet getting appointments for NDC demonstrations remains a challenge. The industry must act now because AI, which builds on NDC, is coming fast.”

Lim highlighted technological integration. “We are normalising NDC with EDIFACT, reducing training needs. Travelport users will soon see a seamless experience, ensuring easy adoption.”

Puri emphasised on awareness. “Many agents don’t fully understand NDC, but it’s the future. With multiple access points now available, adapting to it is essential.”

A boon or a bane?

Machado compared NDC’s evolution to cloud migration, noting, “Some companies have fully moved, while others still operate in hybrid mode. Similarly, some airlines have embraced NDC, while others are yet to release their specifications. The question is—are we preparing enough?”

Samuel highlighted India’s rapid adoption. “Post-pandemic, NDC has accelerated, and India is the fastest to adapt. It will move even faster next year, with Indigo and Air India coming on board,” he said.

Emphasising its necessity, Lim said, “NDC is a standard language for the industry to remain competitive. It won’t disappear if we focus on what truly matters.”

Framing it as inevitable, Puri said, “Just like WhatsApp, we must decide if NDC is a boon or bane. Closing our eyes won’t stop its progress. As retailing expands, we must adapt, or automation will take over. NDC and APIs are essential for innovation, and collaboration is key to success.”

TravTalk India Online Magazine

TravTalk India Online Magazine