Indian hotels are grappling with the growing demand–supply gap in room availability. With operators reporting strong RevPAR gains, new openings, and expanding markets, the industry is bracing for extended high-demand, high-yield growth.

Janice Alyosius

India’s hospitality sector is entering a supply–demand imbalance phase, with new data showing that room additions are no longer keeping pace with the rising travel appetite. This widening gap is set to push room rates higher over the next two years, reshaping pricing power across metro and emerging markets.

ICRA’s latest outlook underscores this shift clearly. While premium room supply is projected to grow at a CAGR of 5–6 per cent between FY2025 and FY2028, demand is forecast to rise at a significantly stronger 8–10 per cent. As a result, nationwide premium occupancies are expected to improve by 200 basis points to 72–74 per cent, while ARRs are set to reach `8,200–8,500 in FY2026. With India posting three consecutive years of double-digit revenue expansion, the sector is deep into a bullish cycle. The next phase, however, will reward brands that can navigate land constraints in metros, tap into tier II and III city momentum, and sustain rate premiums in a high-demand environment.

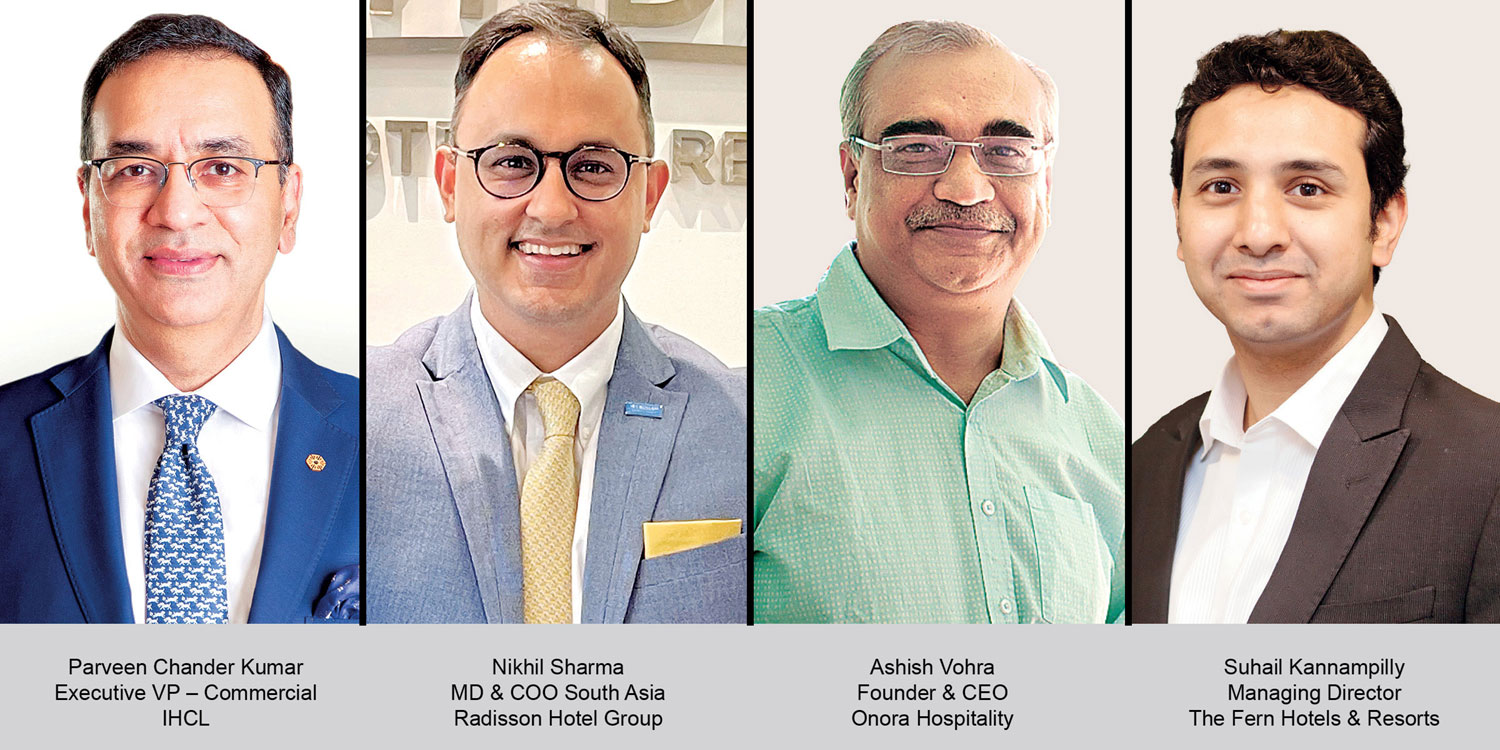

Against this backdrop, leading hotel operators across the country are accelerating their expansion plans, reporting strong pipelines, rising RevPAR, and deeper penetration into emerging micro-markets. Supporting the sector’s optimism, Parveen Chander Kumar, Executive Vice President – Commercial, IHCL, said, “IHCL has a portfolio of 591 hotels with 319 in the pipeline. In H1 FY2026, IHCL clocked a consolidated revenue of `4,226 crore, a 21 per cent growth over the previous year. Domestic hotels delivered a 9 per cent RevPAR growth with international hotels clocking an 11 per cent RevPAR growth. In H1, we opened 26 hotels, including a Taj in Alibaug, Raichak, and Udaipur, a SeleQtions resort in Lakshadweep and Haridwar, a Vivanta in Thane, Gateway in Goa, Coorg, and Ahmedabad, and a Ginger in Dehradun, among others.”

The premium segment’s momentum is mirrored in global brands scaling up rapidly in India.

Nikhil Sharma, Managing Director & COO, South Asia, Radisson Hotel Group, noted, “The past year has been an exceptionally strong one for Radisson Hotel Group in South Asia. We have delivered portfolio-level growth of 14 per cent, driven by a 15 per cent rise in room revenue.”

Independent and experiential hospitality players are also strengthening performance as demand spills beyond metros. Ashish Vohra, Founder & CEO, Onora Hospitality, shared, “Over the past year, our portfolio has shown steady performance. We recorded approximately 6 per cent growth in occupancy, ARR, and RevPAR compared to last year.”

Talking about expansion, Vohra confirmed five openings until March 2026 across Jawai, Amritsar, Rishikesh, Banaras, and Chail, with eight more in the pipeline, including properties at Puducherry, Rishikesh, Nagpur, Ayodhya, Udaipur, and Delhi. Adding his perspective to the rate stabilisation, he said, “Metro pricing is set to stabilise as global sentiment shifts from exuberance to cautious optimism. New airports like Navi Mumbai, Jewar, and Hosur will reshape travel flows and gradually bring more balance to rate dynamics.”

Sustained regional growth is also driving aggressive expansion at The Fern Hotels & Resorts, which now has over 100 operational properties. “Over the past year, we have seen healthy performance across our portfolio. Demand has strengthened across properties, especially leisure destinations, and tier II and III cities have continued to outperform,” said Suhail Kannampilly, Managing Director, The Fern Hotels & Resorts. The Fern currently has over 30 properties in its active pipeline. “Metro markets are experiencing elevated ADRs due to strong demand fundamentals and compressed supply. Rate stabilisation will occur once business travel, leisure mobility, and events reach a predictable rhythm,” he added.

TravTalk India Online Magazine

TravTalk India Online Magazine