In view of the Niti Aayog and Finance Ministry suggesting privatisation of the national carrier, there are lots of questions arising over the need of this step and how it would pan out, if at all.

NISHA VERMA

Union Finance Minister Arun Jaitley recently suggested disinvestment of Air India owing to the debt the airline has till date. This comes after Niti Aayog—the government think tank—had recommended strategic disinvestment recently, claiming that the centre does not need to put in more money into the PSU despite it being in debt of around Rs. 50,000 crore.

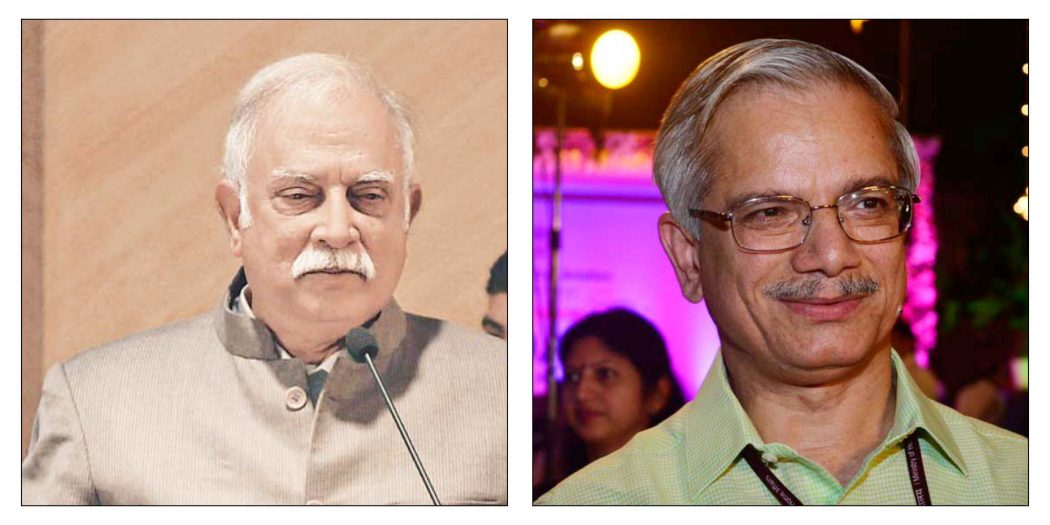

P. Ashok Gajapathi Raju, Union Minister, Civil Aviation, reportedly said, “Niti Aayog has made a recommendation for the course of action for Air India. They have suggested to take steps to make it a strong and viable airline.” He revealed that they were examining all courses of action to ensure this and they are not closed to any options. Similar thoughts were echoed by Jayant Sinha, Minister of State for Civil Aviation.

R.N. Choubey, Secretary, Civil Aviation, claimed that the government’s primary focus is to deal with the debt. “I don’t think it’s easy to have a strategy for Air India right now. Selling the airline would of course be difficult because of the debt overhang it has. There are recommendations coming from all quarters, but the single most important thing is how to handle the debt. Once we find a solution to that, which will require huge buy-in by the finance ministry and the banks, then we can have a few options available, and we will decide what to do. If we solve the debt problem, we will see if there is still the need to privatise Air India, as there are many people who want the government to retain the airline in its fold,” he said.

Saying that debt restructuring or debt swap is also an option, Choubey claimed that all this comes after a decision is taken by the ministry, which is still not clear. “Right now, as an option, there are other assets with Air India as well. If the government takes a decision to sell it, they will see if its gets more money by selling all the assets together or by selling all of them separately but simultaneously. That is a decision the government will take after a transaction advisor analyses things.”

Speaking on the Finance Minister’s statement, Choubey said that the minister was only sharing his views. He insisted that stopping investments in Air India is only half the solution, as it could lead to the sinking of the airline. The other half of the problem is yet to be solved. However, he asserted that the employees’ interest will be completely protected in every scenario. In fact, he said that manpower expenses are not a problem with Air India. “There has been no recruitment in Air India for the last 20 years, except for pilots and cabin crew. As a result, the per aircraft to manpower ratio is about 120:125 which is comparable to any other airline. Twenty years back, it was twice this number. Thus, now owing to low manpower, at least that one burden is not there. We only have to handle the debt burden, not the manpower burden,” he added

TravTalk India Online Magazine

TravTalk India Online Magazine