Hospitality leaders say keeping in view the demand, there is a need to add more hotels in the country. They stress the need for expanded infrastructure, rate parity, and balanced inventory, especially for weddings.

Janice Alyosius

The Indian tourism and hospitality sector is currently riding a wave of growth, driven by a surge in domestic travel, weddings, and inbound tourism. However, this momentum brings its own set of challenges; managing inventory during peak wedding seasons, sustaining commitments to inbound travellers, and expanding infrastructure to meet future demands. Hospitality leaders share insights on how they are navigating the challenges, unveiling a blend of innovative strategies and collaborations and meeting pace with the sustained growth.

Domestic tourism and the government’s role

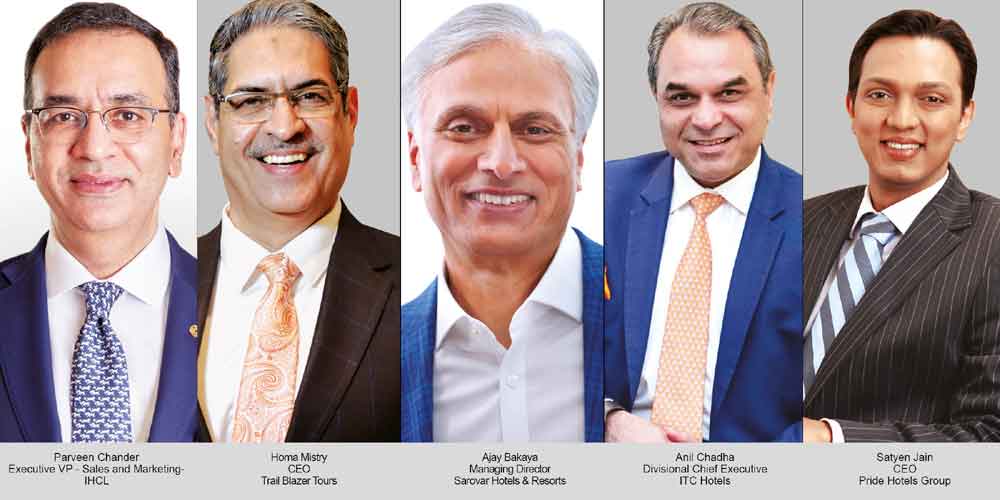

In recent years, government tourism policies have increasingly focused on promoting domestic travel, and this shift is driving much of the sector’s current growth. Ajay Bakaya, Managing Director, Sarovar Hotels & Resorts, observed that while inbound tourism remains crucial, domestic travel is currently the key market, “Domestic is the flavour,” Bakaya said, noting that this area offers substantial growth potential. Sarovar is on track to deliver over 50,000 room nights this year, largely fuelled by domestic demand, he revealed. With “a stable government, strong, steady policies, inflation in check”, Bakaya expressed optimism that India’s tourism environment is primed for significant expansion. However, Bakaya pointed out that the prioritisation of domestic travel may require inbound-focused operators to look towards niche markets like NRIs, medical, and religious tourism.

Rising demand for weddings

The growth of the wedding industry has led to intense demand for hotel space, often creating competition between weddings and inbound groups. “Today, because of weddings, it is difficult to get rooms or accommodation,” said Homa Mistry, CEO, Trail Blazer Tours. This demand is particularly high in prime locations, such as the Golden Triangle and South India, where limited infrastructure restricts hotel capacity. Mistry pointed to a need for hoteliers to set aside a portion of their inventory exclusively for inbound clients, “There must be a small percentage in your inventory – five or 10 per cent – that, come what may, even if there is a buyout, if there is a commitment already made, we will let it pass through for our international clients.”

Parveen Chander, Executive Vice President, – Sales and Marketing- IHCL, discussed how IHCL is managing the surge in wedding demand. IHCL has implemented a policy of reserving 15 per cent of inventory out of buyouts, ensuring general availability for inbound clients even during peak wedding seasons. “For the whole financial year, we said that we are going to be careful with buyouts. That 15 per cent will be left off,” he noted. However, Chander acknowledged that even this allocation can fill up quickly due to the first come first served nature of bookings, adding, “Sometimes that 15 per cent is also not enough because it’s on a first come first served basis.”

To address these issues, IHCL has invested in expanding its footprint, especially in wedding hotspots like Jaipur and Udaipur, which now have six IHCL properties combined.

Managing rate parity

The challenge of balancing high-demand periods for weddings with commitments to international clients has prompted hotel chains to implement strict rate parity and allocation policies. Sarovar Hotels, for instance, has made significant progress in this area. Bakaya shared that Sarovar’s rate parity on net rates rose from 61 per cent in February 2023 to 84 per cent by August 2024, underscoring their efforts to maintain consistent rates across markets. This level playing field benefits inbound clients, as well as wedding and event guests, building trust and stability for long-term partnerships.

Expanding into new markets

To better manage the rising demand in traditional hotspots, hospitality leaders see a clear opportunity to develop new destinations and purpose-built wedding venues. Bakaya advocated for “moving weddings to places like Bhopal and Indore, away from the Rajasthan, Kerala, and Goa scenario.” He also highlighted the untapped potential of resort developments within a three-hour drive from major cities. “A resort which caters to weddings, conferences, and MICE events and doesn’t interfere with inbound at all,” Bakaya envisioned, suggesting that this approach could unlock new growth opportunities in regions with lower development costs.

Anil Chadha, Divisional Chief Executive, ITC Hotels, echoed similar sentiments. “The wedding segment is on the rise. It’s not going to stop,” Chadha said. He urged the industry to maintain the value of India’s offerings, saying, “Have faith in your own hotels, your own hospitality. This is our time. It will never come back.” His appeal is for tour operators and hoteliers alike to avoid over-discounting.

Infrastructure expansion

Several leaders also underscored the long-term benefits of infrastructure expansion as a solution to meet growing demand. Satyen Jain, CEO, Pride Hotels Group, said that their company has set aside 15 per cent of its inventory to honour commitments to large events.

TravTalk India Online Magazine

TravTalk India Online Magazine