‘I am a sharp critic of airline commercial policies and believe they definitely need to be strongly regulated so interests of the distribution industry – GDS, travel agents and tour operators who play a pivotal role in facilitating airline consumers – are also recognised and protected,’ asserts Seema Luthra, Founder, Travel Metrics.

Advocating the interests of the distribution industry is a path I will pursue in good times and bad however we live in peculiar times now and other issues are playing on my mind concerning the greater good of all.

I am speaking about the uncompetitive cost structures in Indian Aviation which probably drives airlines to become self-centred at the cost of their distributors and even the passengers. Air Transportation plays a key role in enabling travel & tourism activities. Aviation’s importance for tourism is clearly evident during the on-going COVID-19, when countries put a hard stop on air travel causing all tourism activities to come to a standstill.

The multiplier effect of travel & tourism has been stated in many studies worldwide and is established beyond doubt . There is a wealth of data on this subject. In 2019, approximately 1.5 billion tourists crossed national borders, and more than half of them travelled to their destinations by air. In India the % of tourist arrivals by air is 79.8%. In 2019, aviation supported more than 40 million jobs within the tourism sector, and through this contributed approximately 800 billion euros to the world’s GDP. Aviation supports $3.5 trillion in world economic activity (4.1% of global gross domestic product). The world’s airlines carry over four billion passengers a year and nearly 61 million tonnes of freight. Providing these services creates 11.3 million direct jobs and directly contributes $961.3 billion to global GDP.

Picture this – a manufacturing industrial unit that is set up from ground takes few years to operationalize, generate employment and income for the local communities but a tourist generates instant economic benefit upon his arrival in any community or geography. This is the reason why a large number of countries invite tourists from India. Every state and each union territory of India is courting tourists from India and overseas. Because Indian tourists are lavish spenders and provide high volume of traffic to domestic and international destinations which is great for development of tourism related infrastructure at these destinations, i.e. airports, hotels, restaurants, entertainment, ground transportation and this in turn induces demand for automobiles, construction materials, food materials, arts & handicrafts and add to that, immeasurable economic benefits of a prosperous local community on sectors like education, health and housing, etc.

Air Transport is a key driver for trade and commerce. As per ATAG, Last year just over 58 million tonnes of goods were transported by air. Moreover, small volumes of air cargo are equivalent to large values in world trade: while in terms of transported weight, aviation accounts for no more than 0.5% of the total, this represents 35% of world trade in terms of value. An estimated $6.5 trillion in cargo value was sent by air in 2019. The advantage of aviation over other modes of transport as regards speed and reliability has also contributed to the market for express delivery services closely linked to e-commerce and perishable commodities. Currently, about 86% of e-commerce deliveries are transported by air at some stage. Air Transport is vital for supply chains across all industries.

For sustainable low air ticket prices and freight charges, it is imperative that the cost of providing air transport is globally competitive

Isn’t it ironical that in our country where we allow Foreign equity up to 100% by means of automatic approvals pertaining to establishment of Greenfield airports; Foreign equity up to 74% by means of automatic approvals pertaining to the existing airports; Up to 49% of foreign equity by means of Published on 23.11.20, Revised on 26.11.20; automatic approvals pertaining to the domestic air transport services; Up to 100% of NRI investment by means of automatic approvals pertaining to the domestic air transport services but we have the most draconian cost structures to operate air transport services. . Spare a thought for the private airport and airline operators suffering huge losses.

In a post COVID era, I wonder where India ranks in terms of preference for an international airline to commence flights for leisure travel given our high cost structures for airlines. The highly taxed fuel costs may well be a key deterrent for tourism to India and governments in key tourism gateways like Delhi, Mumbai, Goa, Kerala, Rajasthan are responsible for this penny wise-pound foolish situation. A Union Territory like Delhi has built an Aerocity and seemingly recognizes the potential of air travel for business and tourism but look at the mind blowing taxes imposed on ATF. These governments are doing a disservice to the nation by their rigid irrationalism and refusal to allow ATF under the GST regime. ATF makes up for almost half of the cost of an airline and rates vary from state to state depending on local VAT. Jet fuel’s inclusion in GST would allow airlines to take input tax credit on the GST paid, thus bringing down the effective cost to a great extent.

COVID-19 has delivered a body blow to the Aviation and Tourism Industry as demand diminished for most part of 2020 and while the enthusiastic tweets from Ministry of Civil Aviation indicate that we can hope for a return to normal operations in the foreseeable future at least for domestic operations however the effects of digitization and the benefits from a Work from Home culture will ensure travel budgets for Indian Corporates will be significantly lower in the coming years as the recent results from IT biggies with significant travel costs like TCS, Infosys and Wipro are suggesting therefore the dependence on price sensitive SME & leisure travel segment will be much higher.

Now it becomes critical for the state governments to urgently facilitate the aviation and tourism sectors to lower their cost structures significantly to stay afloat and be able to cater to the demands of the proportionately larger segment of leisure travellers.

Since corporates are likely to spend less on air travel and it is impossible to determine the necessity and purpose of travel in any case, it would be advisable to lower the GST on airline tickets & disallow input tax credit as this would allow the states and UT to retain the tax while lowering the price of airline tickets for the Indian corporate as well as leisure travellers so the larger economy can benefit from it. Hopefully this will also take the pressure off the good costs like cost of distribution.

It is time for the travel & tourism fraternity to pause, look at the bigger picture and aggressively campaign for tax reforms for the aviation industry because therein lies a direct benefit for all.

I have checked with a domestic LCC and understand the VAT ranges from 20 to 22 per cent and Excise duty is 11.5%. VAT is also charged on the Excise duty so the tax on tax is completely opposite of the acceptable business practices. I understand in Nov 2020 ATF price in India was around INR 35000 per KL and in comparison the International price is around USD 300 per KL which means that at current rate of exchange rate, ATF in India is approximately 36% higher than international prices.

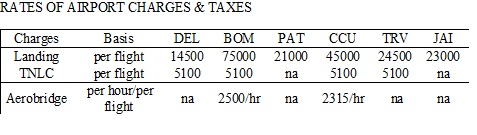

I have also learnt that there is a sharp discrepancy in airport charges as well from airport to airport.

See below illustration.

You cannot help but notice that historically, the airlines which sank had operating bases largely in Mumbai. And among the present lot….

I dare say the precarious financial health of certain domestic carriers is on account of these taxing costs as much as due to their commercial policies but there is a definite correlation between the two.

High operating costs force airlines to focus on cash flow which leads to predatory pricing. In such a scenario, airlines with higher frequencies and bigger fleets sail through but the smaller airlines or legacy carriers with poor balance sheets sink into bigger losses.

I am afraid with the cost structures on ATF and the varied airport charges it will be impossible to curtail the losses of Air India and fetch the right value for this wonderful iconic brand of India. If these issues are addressed, one of our Indian carriers may hopefully buy Air India or it may even survive on its own strength if need be. After all airlines are the face of the country to the world.

Let us, in each state, begin a signature campaign to drive home our point to the one who holds the key i.e the Mukhiya Mantri.

TravTalk India Online Magazine

TravTalk India Online Magazine