Modi Ji… have you really understood the problems of our travel industry?

Time to dive into the problems and turbulences industry has faced in the last 15 Years.

There is no doubt that this government is proactive and quick at decision making, Trying to bring in a positive change but things have certainly gone wrong somewhere for our already suffering travel industry especially for offline players. Perhaps this government hasn’t done deep research on this industry and taken one-sided decisions and damaged it more.

You would ask How? Let’s look back and evaluate a bit.

Abolishment of IATA commissions by most of the Airlines (2001Onwards)

Travel agents were paid 9% commission till 2000. From 2001 the commission was reduced to 7%. In May 2005, the commission was reduced to 5%. In November same year, 16 airlines cut the commission to zero, a move followed by others. In December 2008, the commission was rolled back to 3% by Indian carriers Air India, Jet Airways and Kingfisher Airlines, which is now defunct. Subsequently, others followed suit, and now airlines have again reduced it to 1%. This was probably the first a big blow to our tourism industry as these commissions were a major source of their incomes.

Information Source: Economic Times http://bit.ly/39ELDtF

OTA & Other Intermediaries predatory pricing, w major disruptor (2006 Onwards)

Biggest change, biggest disruption. The Online Travel Agencies (OTAs) have been one major disruptor to online distribution but other intermediaries have also come along and have further impacted the industry, such as Google, Facebook, Trip Advisor, metasearch sites and Airbnb. Tourism business which was synonyms to service-oriented experience has now become a commodity. Even the hoteliers are presented with a strategic challenge of controlling their distribution, where hoteliers need to compete for the online guest, utilising technology, direct deals, value ads, upgrades, loyalty bonus etc. and manage to get the booker directly to their websites.

Now, where does the offline travel business owner’s stand here is my question? Modi Ji will answer- times have changed, its digital India, one must upgrade its technology and build your own portal.

My question to Modi Ji is, who will fund them for expensive technology and its ongoing maintenance? Even if few are able to get there, how will they survive and compete with consistent heavy discounts by Indian OTAs solely funded thru heavy foreign funding? In a few cases, even the principal hotel is not able to offer the same prices. Where exactly are we going? Why can’t the government first take action on predatory pricing?

Thankfully the market segment along has seen a huge growth in the segment of Offline bookers believing in-service experience overpricing, and the same has kept the offline business alive so far.

Demonetisation (2016 Onwards): It’s a well-known fact that demonetisation had majorly and directly affected the tourism Business. Leisure travel was severely impacted by the slow down due to cash moving out of the market. Nevertheless, the industry supported the government’s decision in the larger interest of the country. But slow down cannot be ignored.

GST- Goods & Service Tax (2017 Onwards):

Another big change, big disruption to the travel business. There are no doubts about the importance of the GST introduction to the Indian economy but the same clearly failed on the philosophy of ‘One Nation One Tax’. Government expected immediate success or rather believes to be successfully implemented. I would say, the government was in quite a hurry and wanted enterprises to gulp the GST capsule and start running.

Believe me, the government doesn’t have slightest of an idea how clueless our travel industry is. Our industry transaction and billings are so complex that it would take years to unlock the most suitable process and implementation without hurting the business and income growth of the travel businesses. Government has not done enough interactions with industry experts and have not published dos & don’ts of the multiple transactions.

Fall of Rupee against US Dollar (2013 – 2020):

Changes in currency rates directly influence spending in a destination. Higher the Dollar, more expensive outbound tour will be. This is also one of the reasons for the steep increase in the value of the outbound remittances. But on the other side, it has also discouraged travellers to travel abroad directly impacting the outbound travel business. Please refer to the chart below to understand the fall of rupee in the last seven years.

| Year | USD (average) |

| 2013-14 | 60.50 |

| 2014-15 | 61.14 |

| 2015-16 | 65.47 |

| 2016-17 | 67.07 |

| 2017-18 | 64.45 |

| 2018-19 | 69.92 |

| 2020 | 72.00 |

| 10-March-20 | 74.00 |

Source:http://bit.ly/2PZYmPK

India – Pakistan surgical attacks and a war-like situation (February 2019):

A matter of national security cannot be compromised and blamed at all. But it’s noteworthy that tourism business tops the list to make the immediate negative impact of postponements, cancellations and huge loss of business. After the strikes in February 2019, Pakistan had closed its air space till the end of July, resulting in a lot of airlines cancelling their flight operations to/from India and of course cancelling plans of both Outbound & inbound travellers.

Jet Airways Shutdown ( April 2019):

The 2ndlargest airline shutting down in middle of the peak season of the travel business put the entire industry in a shock and a loss of revenue for the entire year. Agents struggled for its money circulation for over a year to recover all the money they had invested in buying their clients tickets issued on Jet Airways. All the energies and efforts were wasted in recovering and struggling with cancellation & refunds and a lost season. I know it was not the government’s fault but definitely a worthy concern to help the industry in some way.

Economic Slowdown (2017 – 2019):

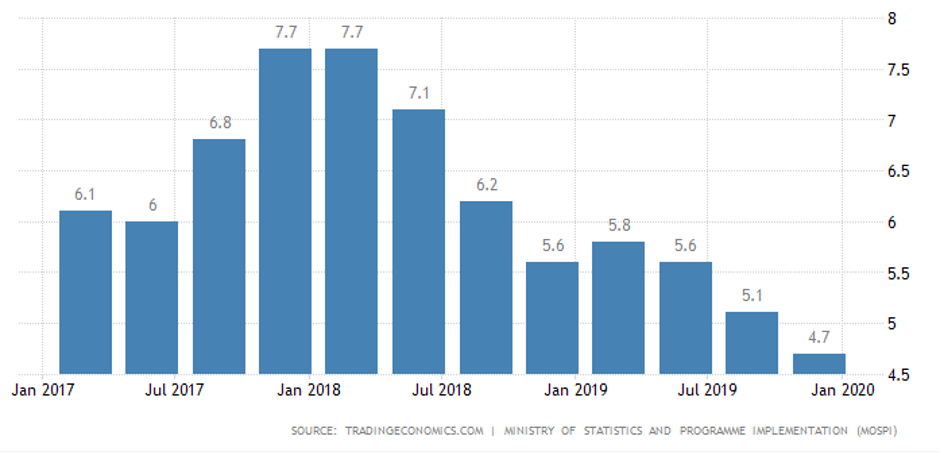

The GDP growth experienced in the last quarter was slowest in more than six years and has touched to 4.7 %. This is alarming. India’s economic growth has taken a hit due to a number of factors and resulted in a slowdown in private consumption & investment. . Travellers have either curtailed or stopped spending on travel.

Source:https://tradingeconomics.com/india/gdp-growth-annual

Citizenship Amendment Act ( CAA ) Outrage (Nov 2019):

The Citizenship Amendment Act (Bill) protests, CAA Protest or CAB Protest had broken out across India and a few of the violent incidents occurred after the enactment of the Citizenship (Amendment) Act (CAA) by the Indian government on December 12, 2019. It triggered widespread ongoing protests across India and abroad against the act. The protests began in Assam, Delhi, Meghalaya, Arunachal Pradesh, and Tripura on 4 December 2019, and quickly spread across the country bringing the tourism business again to a standstill, Especially the inbound business. Few inbound travellers even had to cancel just a few hours before boarding the flights and many passengers were stuck while on tour.

Corona Virus Outbreak (January 2020):

And as the luck would have it…again just before the peak travel season, The coronavirus outbreak that has spread to almost all continents and has brought the travel and tourism sector to a standstill. Fresh cases emerging in India, Africa, Europe and the US, leisure and business travel, both incoming and outgoing, has taken a hit. Travel is not a commodity, it’s not a raw material that you can treat as an unsold inventory and sell the next month. Tourism is a perishable product; every day lost is a loss. For the travel industry, it is very depressing to look at the dark future. Again it’s has nothing to do with the government policy but gives another strong reason to government to consider support to the industry through various measures.

TCS – Tax Collection at Source, Nail in the coffin (February 2020):

Another policy decision directly impacting the outbound travel business. I am not sure if the government have consulted the industry before implementing any policy. We understand that government has its own reasons to track the outbound travellers from India and trust me industry do not have any apprehensions on that aspect but not at the cost of losing customers to a foreign entity located abroad. Refer to the detailed implications this TCS Tax will have directly on the Travel Business and indirectly on the government revenue. Some of the major concerns are, loss of business to overseas vendors and OTA’s operating out of India, cost of compliance, the applicability of TCS on B2B transactions viz a viz buyer or traveller, and many more.

Below are the implications of TCS on Outbound Travel Business from India

- TCS to render Indian Travel Companies Uncompetitive

In absence to force compliance of proposed TCS provisions on ‘Foreign Entities’ (i.e. Foreign agents, suppliers and websites), coupled with lack of restrictions permitting an Indian Traveller to make direct payments (Debit Cards/Credit card /Cash on arrival Payments or any other similar mode) to foreign entities, huge volumes of business will shift to such Foreign Entities. This is contrary to the ‘Make In India’ campaign of the government. The industry is already suffering from identical issues as foreign entities are booking holidays for Indian travellers without collecting GST, rendering the cost of the package of Indian travel agent higher and uncompetitive.

Also, critical to note is, amended provisions do not specifically exclude buyers/ tourists residing outside India and buying tour services from Indian agents. Here, it shall be construed that credit will not be available to the buyer, again making the Indian agent uncompetitive.

- Tax Loss to India of Direct Taxes and GST owing to point (i) above

- Unemployment & forced business closure: Proposed TCS rollout, will lower business volumes, marginalise expenses, scaling down or worse shutting down of businesses. Eventually, this will lead to widespread job losses. The tourism sector has created over 4 crore jobs in India in 2019 which was 8.1 per cent of total employment in the country. Please refer to the IBEF Report on Tourism and Hospitality published in December 2019.

- Contrary to Ease of Doing Business – The increased compliances arising from these proposed provisions, will add to the time and costs burden for the businesses, which are still struggling heavily with GST and other statutory compliances. Further, lack clarity on the mechanism for tracking aggregate limits of INR 700,000 for AD remittances, for the travel companies or the government resulting in a delay in closing the transactions.

- Exposure of your earnings/margin to the consumer: For travel companies making foreign remittances the tax has to be collected by authorised dealers. The TCS return filed by the seller or an AD will expose the 5% amount and consequently the cost of the package (buying price).

Key Contributors for the above points on Implications: Rupal Shukla, Bhavyan Dalal and Lovleen Arun

Article authored by: Siddharth Jain, CEO – Sapphire Ventures and Director – Kazin Travel Consultants | sj@svindia.in | +91 9811330099

(The views expressed are the author’s own. The publication may or may not subscribe to the same)

TravTalk India Online Magazine

TravTalk India Online Magazine