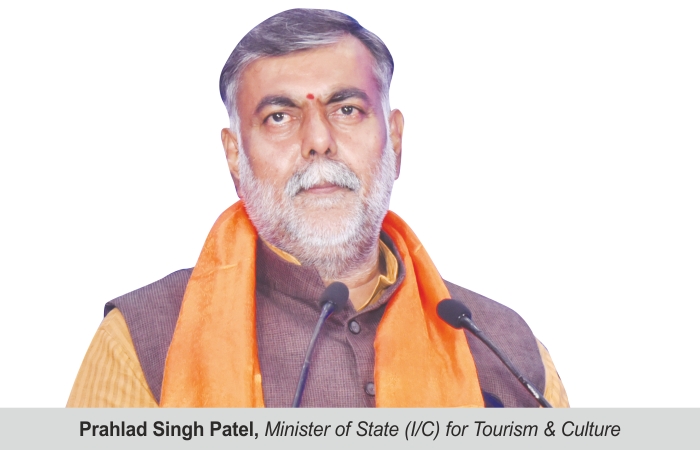

Addressing important queries of parliamentarians pertaining to various issues related to the tourism sector, Prahlad Singh Patel, Minister of State (I/C) for Tourism & Culture, offered written replies in both houses of the Parliament during the Budget session.

Manas Dwivedi

After Finance Minister Nirmala Sitharaman presented the Budget in the Parliament, Tourism Minister Prahlad Singh Patel shared is views on the Budget for his Ministry and also addressed some of the concerns raised by MPs in both the Rajya Sabha and the Lok Sabha through written replies. Among the many issues he addressed were GST rates on hotel rooms and special incentives for tourism, while also divulging information on the effect of COVID-19 on tourism and initiatives and schemes of MOT. The Minister asserted that no MOT project or scheme had been deferred or stalled due to COVID-19. Here’s a look at some of the other questions he answered:

Impact of lockdown and COVID-19 on tourism

On COVID’s impact on the tourism sector, Patel said, “Since the situation is still evolving, the final impact in numerical terms can only be ascertained in due course. However, the Ministry has held several rounds of discussion and brainstorming sessions with industry stakeholders to assess the impact on the segment and has recently engaged the National Council for Applied Economic Research (NCAER) to conduct study on ‘India and the Coronavirus Pandemic: Economic Losses for Households Engaged in Tourism and Policies for Recovery’. One of the objectives of this study is to quantify the sector-wise and overall loss in income of the economy and of the household sector and also the loss in jobs due to the impact of the coronavirus pandemic on the tourism sector. The study will also propose policy measures appropriate to provide relief to the tourism sector.”

Steps to promote domestic tourism

On this, the minister said, “The Ministry has launched the Dekho Apna Desh(DAD) initiative to promote domestic tourism. DAD is promoted extensively on social media accounts and website of the Ministry and by domestic India Tourism offices. The Ministry and the regional offices are regularly communicating with the travel industry and other stakeholders on issues related to opening up of the tourism sector, handling of tourists, protocols of safety and security, service standards, etc.”

Special incentive to tourism sector

When asked about the impact of COVID-19 on tourist arrivals in the country, the Minister said that on the basis of information received from Bureau of Immigration (BOI), Foreign Tourist Arrivals (FTAs) in the country declined by 75.50 per cent in 2020. On the estimated revenue loss to the tourism industry in 2020, Patel said that no formal study had been instituted for assessment of loss of revenue in 2020. However, several rounds of discussion and brainstorming sessions with industry stakeholders indicate massive loss of revenue, foreign exchange and jobs. “In view of the highly unorganised nature of the sector, the impact in numerical terms can only be ascertained in due course,” he added. When asked whether the government had provided any special incentive to the tourism sector to overcome COVID’s impact, the Minister spoke about revised guidelines of the MDA scheme. When asked about details for planning such an incentive, the minister replied, “Does not arise.”

Vaccine certification for foreign tourists

On the question of the government’s plan to set up a vaccine certification programme for foreign tourists, Patel replied, “Government of India’s COVID-19 vaccination programme will provide priority to healthcare and frontline workers followed by those above 50 years of age and then under-50 population groups. No plan for setting up a vaccine certification programme for foreign tourists has been announced yet.”

Reducing GST on hotel room rates

When asked if the Ministry will consider approaching the GST Council for reducing GST on all hotel rooms to 12 per cent in view of the severe impact on tourism sector, particularly the hotel industry, Patel said, “MOT is aware of taxes levied on tourism products, including hotels. At present, Ministry of Tourism has no plan to approach the GST Council for reducing GST on all hotel rooms to 12 per cent, since the GST Council decides the rate of taxation after taking into consideration the factors affecting various segments of business as well as to ensure optimum revenue generation required for overall development of the economy.”

TravTalk India Online Magazine

TravTalk India Online Magazine