A reduced e-Tourist Visa fee, a lower GST rate for hotels and the annual India Tourism Mart are helping create an ideal environment for the growth of the industry. The true impact, however, is yet to be seen.

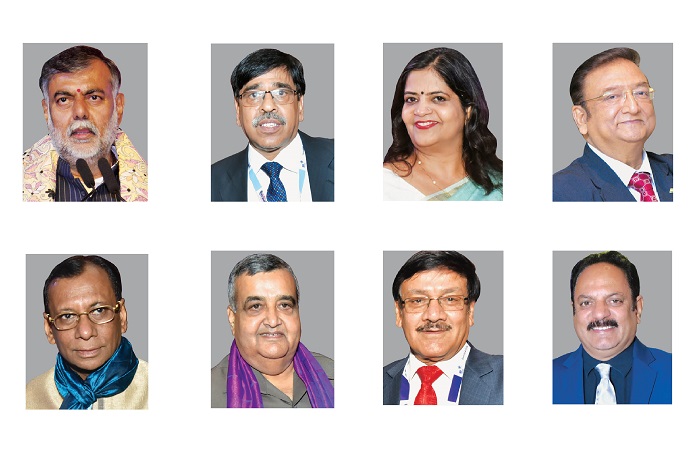

Prahlad Singh Patel, Minister of State (I/C), Tourism and Culture, Government of India

The 9ST rate reduction will benefit the hospitality sector and will go a long way in promoting tourism. A reduction in the visa fee was not just a demand but a need of the industry, and we accepted and worked towards it. It is important to both invest in and earn from tourism. To do that, it is necessary to change the perception of the country and several steps are being taken to increase the number of tourists to India.

Yogendra Tripathi, Secretary – Tourism, Government of India

The government has taken all steps to make tourism competitive in the country and to ensure that tourists get attracted to the destination. Now, it’s for trade participants and businessmen to make use of this opportunity and make it a success. We would like to see the number of tourists to the country increase, and the visa fee reduction, GST reduction, as well as the India Tourism Mart are necessary steps in making this happen.

Meenakshi Sharma, Director General – Tourism, Government of India

The GST rate for hotels has been reduced, corporate tax rates have been reduced, there is a huge reduction in visa fee, and new e-Tourist visas for one month at $25 and at $10 for the lean period have been introduced. This is a very good time as far as infra- structure, promotion, and facilitation are concerned. We are hoping this will create economic growth and employment opportunities for India.

Subhash Goyal, Honorary Secretary, FAITH

The Prime Minister’s vision for tourism arrivals is to go from 10 million to 20 million. All steps by the government are taking us to the 20 million target. The India package is going to become cheaper, and the visa fee reduction is going to work in a better manner. The visa fee was earlier a deterrent for a family traveling to India, but not anymore. The reduced visa fee and GST, as well as events like ITM, are going to benefit the growth of Indian tourism.

JK Mohanty, Chairman, HRAO

The reduction of visa fee, the Goods & Services Tax, as well as other initiatives that the government is taking up time and again, would help develop the tourism sector and make the country more attractive for tourists. My only wish, however, is to get more international flights and connectivity to Odisha. Right now, we have flights only to Kuala Lumpur and Bangkok, but we need more international connectivity that can boost tourism to the state of Odisha.

Rajiv Mehra, Vice President, IATO

The Indian visa is now being looked at as an equivalent, maybe even more attractive than the visa of neighboring countries, which is a significant development. A key problem with the Goods & Services Tax, however, is that the benefit now needs to be passed on to the end user. Once this happens, tourism to India would increase exponentially. Though it might not happen immediately, I am hopeful that January to April would be good months for tourism in 2020.

PP Khanna, President, ADTOI

We are sure that these measures will help increase inbound as well as domestic tourism in the country. Earlier, even the domestic buyer thought of India as an expensive destination and hence, went abroad. Outbound tourism was already on the rise and now, with the reduction in GST, we are sure that inbound and domestic tourism will definitely grow.

Sanjay Narula, Vice President, TAAI

While the industry does expect more, this is a huge first step to boost tourist traffic to India and meet the target that we have set out to achieve. A lot more money has been put in the hands of the companies and the people, by reducing tariff and the Goods & Services Tax on hotels. This way, a lot of pressure has been cleared in terms of affordability. While this is a positive move for inbound and domestic tourism, it will take some time for results to take shape.

TravTalk India Online Magazine

TravTalk India Online Magazine